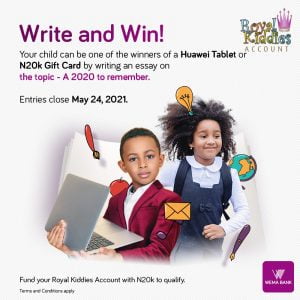

Nigeria’s long-standing innovative bank, Wema Bank, has announced that it’s looking for the best essays written by kids. In this forthcoming essay competition, ten winners from its Royal Kiddies account holders will be rewarded.

With an essay submission, your wards can win any of its amazing prizes. To join the fun, follow these steps:

- Fund your ward’s Royal Kiddies Account with a minimum of N20,000,

- Send a mail to [email protected] with account information and his/her essay submission.

Contents

Prizes to be won:

The top three Essays will get Huawei tablets and Royal Kiddies branded T-shirts.

The seven other finalists will get a N20,000 prepaid gift card for school supplies plus a branded T-shirt.

Essay submission entries close by May 24, 2021. (Terms and Conditions apply)

Don’t have a Royal Kiddies Account? check the details below for the account requirements.

What is Wema Bank Royal Kiddies Account?

Children get an early start to financial freedom at Wema Bank with our Royal Kiddies Account designed for ages 0 to 12.

Opening a Royal Kiddies account for your children gives you access to school fees advance, scholarships, and life assurance to fund their education.

What are the Features of Wema Bank Royal Kiddies Account?

- The account is operated by the parent/guardian who may or may not have an account with Wema Bank

- Minimum opening balance of N2,000

- Competitive interest rate (2.15%)

- Limited withdrawals – Max of 1 withdrawal/month to qualify for interest payment

- Lodgment of dividend warrants & cheques in the child’s name is allowed

- No debit card would be issued on this account

- A Royal Kiddies e-purse will be made available on request.

What are the Benefits of Wema Bank Royal Kiddies Account to Customers?

- Helps parents to save for their child’s future.

- Helps to teach a child the importance of saving from a young age and introduces the child to use financial channels through the Royal Kiddies e-purse.

- Ensures continuity of child’s education in case of death of parent or guardian.

- Allows standing order for regular savings from parent’s/guardian’s accounts for payment of school fees

- Higher interest rate than a standard savings account.

- Eligibility for the annual Wema Educational Award

- Transaction alerts through SMS and/or E-mail

What are the Documents Required to Open Wema Bank Royal Kiddies Account?

- Duly completed account opening form including signature mandate card

- Copy of National ID card, Driver’s License, Voters ID, or International Passport of the account administrator (parents/guardian)

- 1 passport photograph each for parent/guardian and child/ward and alternate administrator

- BVN of administrator & Alternate administrator (Where applicable)

- Birth certificate or School ID of the child

- Copy of utility bill (Water, electricity, Waste, or telephone) issued within the last three months.

Visit any Wema Bank branch close to you to get started.