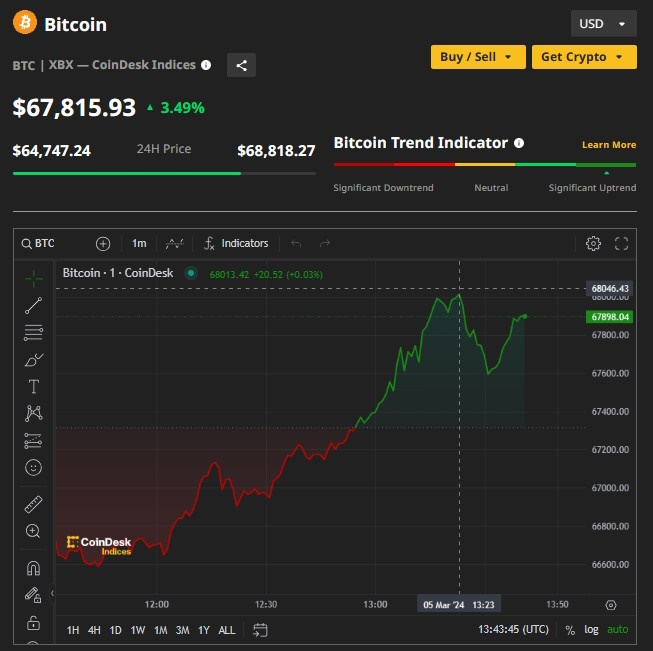

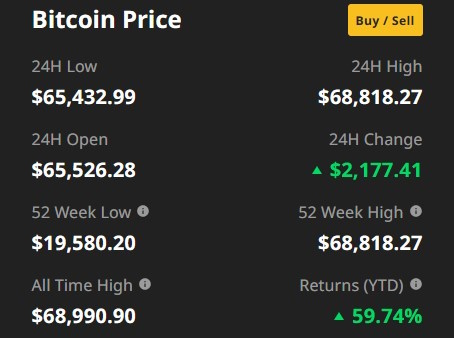

Bitcoin’s price is making headlines again, and for good reason! It just smashed past the $68,000 mark, teasing us with another potential record-breaking run. Naturally, the question on everyone’s mind is whether the current Bitcoin price momentum could push it to new all-time highs. Let’s dive into what’s driving this rally and figure out where this wild ride might take us.

Contents

The Forces Fueling the Bitcoin Price Surge

The recent surge in Bitcoin’s price isn’t down to a single factor. Here’s a breakdown of what’s propelling it upward:

- ETFs: The Institutional Gateway: The introduction of spot Bitcoin ETFs in the US has unlocked a massive wave of institutional investment. These funds make it considerably easier for large investors to become involved, raising demand and driving the Bitcoin price higher.

- Inflation Hedge: As inflation concerns grow, clever investors are turning to Bitcoin as a viable hedge. Its restricted supply and decentralized character make it a desirable, inflation-resistant alternative to traditional safe-haven assets like gold.

- Technological Advancements: Continuous improvements to Bitcoin’s underlying technology, particularly scaling solutions like the Lightning Network, make it faster and more efficient. This boosts Bitcoin’s price by increasing its utility and attracting long-term investors.

- Corporate Backing: Tesla, MicroStrategy, and a growing list of major companies are putting real money into Bitcoin. This corporate endorsement builds trust in crypto and drives up the Bitcoin price by expanding mainstream interest.

Bitcoin Price Prediction: Will History Repeat, or Could It Be Even Better?

Bitcoin’s weekly price chart shows a bullish rollercoaster. It has gone over barrier after barrier, and the all-time high of $69,000 appears to be well within sight.

“We’re seeing serious action during regular trading hours, which is a strong sign of institutional involvement,” says Antoni Trenchev, Nexo cofounder. “This isn’t just a weekend pump-and-dump anymore.”

Where could the Bitcoin price go from here? It’s always risky to predict a volatile market like crypto, but the current sentiment leans heavily towards further upside. A decisive break of the $69,000 threshold seems likely shortly. Some bullish analysts are even dreaming of $100,000 price targets further down the road. Remember, though, that crypto is famous for its dips as well as its peaks – a long-term perspective is key.

Beyond Bitcoin: The Ripple Effect

Bitcoin’s surge naturally impacts the wider crypto market:

- Ethereum’s Rise: ETH, the second-largest cryptocurrency, is riding Bitcoin’s wave and reaching multi-year highs of its own. Those rumors of potential Ethereum ETFs aren’t hurting either!

- Meme Coin Resurgence: Even speculative meme coins like Dogecoin (DOGE), Shiba Inu (SHIB), BNB (Binance Coin), and PEPE have experienced remarkable price rallies, highlighting a renewed surge of retail investor interest in the crypto landscape.

- Bitcoin’s Financial Force: Bitcoin’s market cap just zoomed past $1.3 trillion, blasting past Meta and inching closer to the value of silver. That kind of growth is what turns the heads of traditional investors and pushes Bitcoin’s price ever higher.

“The tides are turning for Bitcoin’s perception,” says Marie Tranchant, a crypto analyst at Accenture. “Technological advancements like the Lightning Network are addressing scalability concerns, making Bitcoin a more viable option for everyday transactions. This enhanced utility is fueling investor confidence and pushing Bitcoin’s value proposition beyond just a store of value.”

A Moment in Crypto History

Whether you’re a seasoned crypto investor or just getting started, you can’t ignore the current Bitcoin price activity. We’re not only seeing a price change; we’re seeing the rising acceptability of a completely new asset class. It’s going to be a rocky yet fascinating voyage. Buckle up!