Nigeria’s digital finance scene is in turmoil following the CBEX platform crash, an event that’s left users locked out of their accounts and sparked widespread panic. Social media is buzzing with reports from thousands fearing their savings are gone, stuck inside the now-inaccessible CBEX app. It’s a stark reminder of the platform’s collapse, and those urgent Ponzi scheme warnings we’ve heard before? They’re echoing louder now.

Contents

Understanding the CBEX App Platform

The CBEX app gained popularity in Nigeria partly because it promised sky-high returns—suggesting investors could double their money every single month. In tough economic times, that kind of offer was hard for many Nigerians to resist, driving lots of users to the platform. But models like this often flash warning signs, echoing expert concerns about potential Ponzi structures hiding behind a slick app interface like the CBEX app‘s.

The Crisis Unfolds: A Sudden Platform Crash

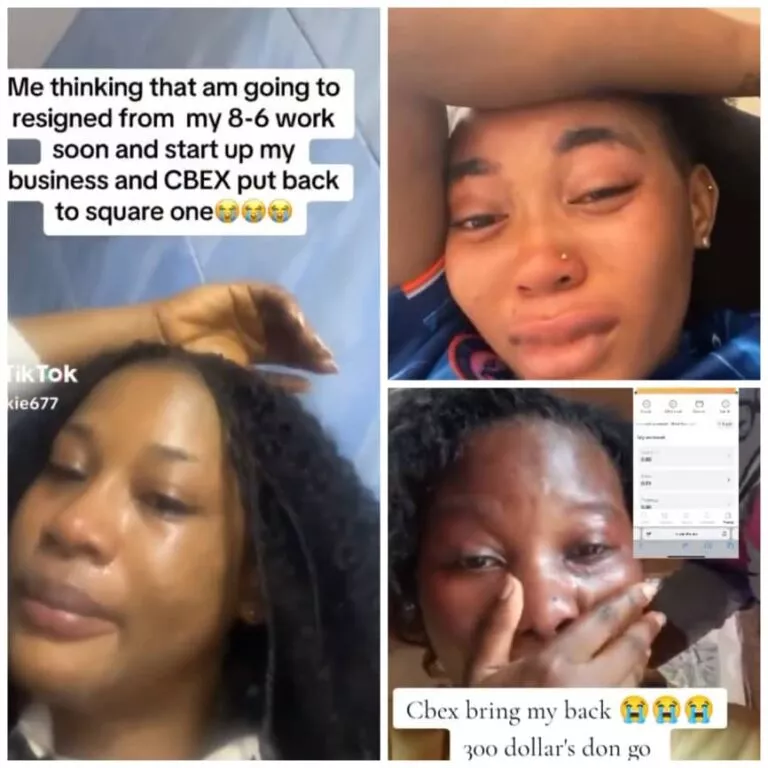

For users, the platform basically crashed over the weekend. What started as withdrawal glitches quickly snowballed into users being completely locked out of their CBEX app accounts by Monday. Predictably, this triggered waves of distress online, with people sharing tearful stories and feeling utterly betrayed. The situation even boiled over in Ibadan, Oyo State, where frustrated customers reportedly found a CBEX office deserted, pointing to a serious operational breakdown.

The stories coming out highlight just how bad the crash is. Ola’s potential ₦450,000 (~$280) loss and unverified reports of others losing huge sums (some mention up to $16,000) show the real financial pain caused by the CBEX app suddenly failing.

CBEX’s Silence Amidst the Crash

Making things worse, CBEX has been conspicuously silent. Sure, there were scattered, unverified messages on private Telegram channels blaming a “hack” and promising fixes, but no official word from the company itself. This kind of radio silence during a crash isn’t normal for any real financial service and just makes people more anxious and suspicious about the whole CBEX app operation.

Analyzing the Red Flags: Why Ponzi Warnings Echoed

This CBEX platform crash didn’t exactly come out of the blue for seasoned observers. Several red flags, often warned about regarding potential Ponzi schemes, were there all along:

- Crazy Returns: Promising to double money monthly? That’s a classic red flag. Real investments just don’t deliver guaranteed returns like that safely. It screams HYIP (High-Yield Investment Program), which are often Ponzi fronts.

- Murky Regulation: It wasn’t clear if the CBEX app was even registered or watched over by bodies like Nigeria’s SEC. Operating outside the rules is common for shady schemes.

- Lack of Transparency: Relying on Telegram chats for updates and staying silent now? Not a good look. Real financial outfits are transparent, especially when there’s trouble.

Put together, these signs look alarmingly similar to known Ponzi schemes, making the CBEX app situation feel like those warnings coming true.

Historical Parallels: The Echo of MMM’s Collapse

This CBEX platform crash feels a lot like the collapse of the infamous MMM scheme in Nigeria back in 2016. MMM also promised crazy returns, pulled in millions, then froze accounts, causing massive losses. That history is echoing now, reinforcing those warnings against platforms acting this way. The pain CBEX app users are feeling is tragically familiar.

What Next After the CBEX Platform Crash?

Following the CBEX platform crash, users are left wondering what’s next:

- Will CBEX actually fix things and give people access to their money, or is the platform gone for good?

- Will Nigerian authorities step in to investigate the CBEX app and hold someone accountable?

- Realistically, what chance do users have of getting their trapped funds back?

Without clear answers, users are stuck in limbo—a terrible place to be when a platform crashes.

Protecting Yourself: Heeding the Warnings

This CBEX crash should be a wake-up call: be extremely careful in the digital investment space.

- Check for Regulation: Only use platforms clearly registered and overseen by financial authorities (like the SEC here in Nigeria).

- Question Wild Promises: If returns sound too good to be true, they almost certainly are. Run away.

- Demand Clarity: Understand how a platform supposedly makes money. If it’s vague or relies on new members, be very suspicious.

- Invest Smart: Don’t put in money you can’t afford to lose. Spread your investments across different, regulated options.

- Get Advice: Talk to a qualified, independent financial advisor before jumping into new platforms, especially unfamiliar ones.

Conclusion

The CBEX platform crash is a harsh financial blow affecting thousands of Nigerians. It starkly shows the danger lurking behind promises of quick, easy money. Locked funds and loud Ponzi warnings scream for investor vigilance, better regulatory oversight, and a healthy dose of skepticism towards schemes that value hype over substance. As this unfolds, the lessons from the CBEX app failure need to stick, informing how everyone approaches digital investments in Nigeria going forward.