Nigeria’s first fully digital bank -ALAT, which won an award for “Excellence in Branchless Banking in the New Age Banking Awards” during last year, has announced the upgrade of its app from version 2.2 to version 2.4. The future of banking is here with the latest version of ALAT (called Version 2.4) and it’s mind-blowing features. The upgrade offers you a lot more, but two major features are Virtual Dollar card and Loan Service.

No need to be converted from Naira to Dollars again before you make your payments in foreign currency. You can do it all by yourself immediately through your ALAT account by WEMA Bank and pay in foreign currency. Pay in foreign currency direct in Naira. Start to finish by you. No third party.

Recommended: How to Make Money with WEMA BANK ALAT (The First 100% Digital Banking in Nigeria)

The new upgraded version was the most important update since ALAT app launched in May last year. It comes with 4 exciting features for users, which are:

- Request short-term loans whenever you need them.

- Create your own ALAT Virtual Dollar Card to pay online in dollars. Your first card won’t cost you anything.

- Fund your ALAT account easily from any of your other Nigerian bank accounts.

- Track your debit card requests.

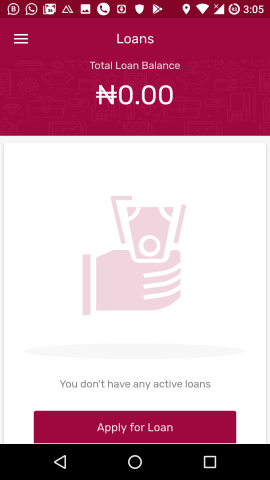

Short-term loans

Users can now request for short-term loans on the ALAT app without the usual stress of queuing up at the bank. It also eliminates the usual paperwork involved in getting a loan as all necessary documents can be uploaded to the app. Now, you can request a short-term loan of up to 100,000 Naira from the comfort of your house. Perfect for the days you’re short on cash (which can happen to almost anyone) and need a quick fix. To request a loan, tap Loans on your updated app’s sidebar menu.

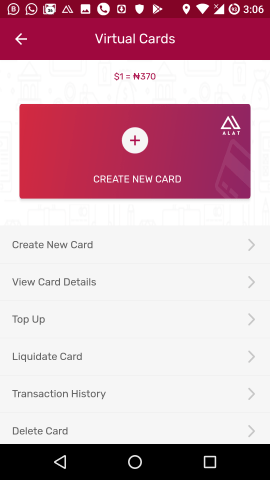

Virtual Dollar Card

No longer do debit cards have to be plastic cards, ALAT introduces the Virtual Dollar Card which resides on your app in digital form and allows users pay in dollars, straight from their ALAT account without the usual hassle of sourcing for dollars when making foreign transactions. It gives users immediate access to the U.S dollars without necessarily owning a domiciliary account. It also eliminates the risk that comes with carrying cash and the stress of converting your Naira to dollars. Like your familiar plastic debit card, you’ll get the usual details (card name, card number, an expiry date and a three-digit CVV number) and you can use these details to pay wherever dollar cards are accepted online. Your first virtual card is free, but you will be required to pay the standard monthly card maintenance fee.

Presently, the conversion rate with ALAT by Wemabank is NGN 370 per 1 USD.

Also Read: All You Need to Know About ALAT Debit MasterCard Powered by WEMA Bank

Fund My Account

This feature allows users fund their account without stepping into the bank. If there ever was a way of reducing the crowd in the banking hall, this is it. Fund My Account Option gives you access to connect your other Nigerian bank accounts to your profile so you can move money to your ALAT account easily.

Card Delivery Tracker

ALAT v2.2 also allows users to activate, lock and unlock their cards, but with ALAT v2.4 users are able to track their cards status anywhere they are. From your ALAT app, you’ll know when your card has been printed and when it’s on its way to you. No questions asked.

The current version ALAT app 2.4 available on Google Play Store and Apple’s App Store.

- For Android users, download it from Google Play Store Here

- For iOS users, download it from App Store Here

Note that the web version of ALAT is not yet updated with the new features.

With ALAT App, customers can sign up in less than 5 minutes, submit relevant documents without ever entering a physical branch, make easy and automated savings to reach their life aspirations and request for their free debit card.

6 thoughts on “Virtual Dollar Card Plus Short-Term Loan of Up to N100,000 Now Added to ALAT V2.4 by WEMA Bank”

There's no point in paying 370 naira/$ and still paying a monthly card maintenance fee. I'll just stick with my GTB and UBA ATM mastercards for my dollar transactions.

Stupid rate… I saw that and found it funny… What's the need then? 9naira difference might seem little, but it's huge!

They are the excellent way out of all you financial problems. Installment loans are a means of borrowing short term short which is to be paid in installments Simpleinstallments

Great job here on. I read a lot of blog posts, but I never heard a topic like this. I Love this topic you made about the blogger's bucket list. Very resourceful. Islamic Finance | Islamic Fintech

Plz can one withdraw from the virtual card?

Yes, you can. It has all the features that other ATM cards have.