Nigeria’s Student Loan Scheme Needs Urgent Course Correction

Launching the Nigerian Education Loan Fund (NELFUND) was a significant step towards helping students from lower-income backgrounds afford higher education. As a vital support system, the student loan scheme aims to take the pressure off tuition fees. However, recent reports and serious allegations about how it’s being run demand immediate attention from President Bola Tinubu’s administration, the Education Ministry, and NELFUND’s leadership under Akintunde Sawyerr. The success of this student loan program is simply too important to jeopardize.

Contents

What’s Going Wrong? Allegations of Mismanagement

Serious questions are emerging about how NELFUND funds are actually reaching students. Both media reports and findings from the National Orientation Agency (NOA) point to problems that threaten the very purpose of the student loan initiative.

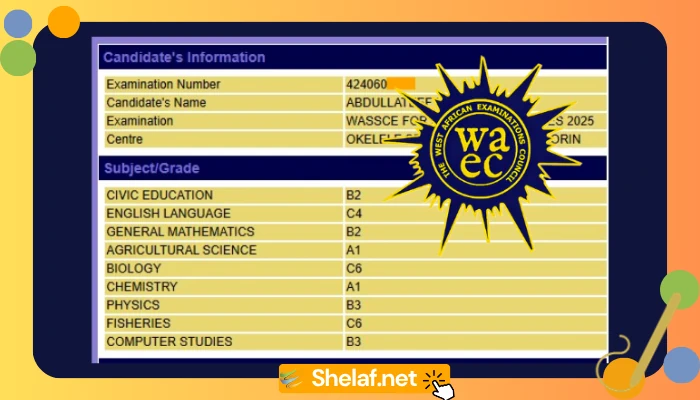

NELFUND states it has disbursed roughly N45.1 billion in loans since the program began in May 2024 through March 2025. Despite this, there seems to be a major disconnect. The NOA Director-General, Lanre Isa-Onilu, shared concerning findings from the field: it appears some universities might be working with banks to deliberately hold up student loan payments meant for tuition. The claim is that these institutions delay processing the funds, effectively letting the money sit in banks—potentially for corrupt purposes—while approved student beneficiaries are left unaware and struggling.

System Flaws and the Toll on Students

Ironically, the student loan process, designed to prevent students from misusing funds by sending money directly from NELFUND to banks and then universities, seems to have opened doors for manipulation by others. The system intended to ensure tuition was paid is reportedly being exploited.

Students bear the brunt of this. Many remain unaware that their student loan has even been approved and the funds supposedly sent to cover their fees. They continue to face pressure from university authorities, including threats of being kicked out of exams. This completely undermines the financial aid meant to secure their place in school and highlights a massive failure in transparency within the student loan system.

Getting Back on Track: Transparency and Accountability Are Key

To restore faith and make the student loan scheme actually work, several decisive steps are essential:

- Make Beneficiary Lists Public: NELFUND needs a clear, accessible, and up-to-date list of who has received a student loan each cycle. This lets students check their status and hold schools accountable.

- Implement Digital Tracking and Alerts: A solid digital system is needed to follow the money from NELFUND to the bank and finally to the university’s account. Crucially, students must get automatic SMS or email alerts the moment their tuition is paid via the student loan. No more guessing.

- Investigate and Prosecute Swiftly: These allegations of delays and mismanagement demand thorough investigation. The ICPC, EFCC, and perhaps the DSS need to work together to find and prosecute any university or bank staff involved in corrupt practices with student loan funds.

- Empower the NOA to Expose Issues: The NOA shouldn’t just report problems; it should be empowered to publicly name institutions confirmed to be blocking the student loan process. Public exposure can be a powerful deterrent.

Looking Bigger Than Just Loans: A Fuller Funding Strategy

Fixing the student loan scheme is crucial, but it isn’t the whole picture for funding Nigerian education. A sustainable strategy also needs:

- More Than Loans: Robust investment in traditional bursaries, scholarships, and grants must continue alongside the loan scheme to offer diverse support.

- Quality Over Quantity: Focusing funds on improving infrastructure, research, and faculty support in existing universities makes more sense than constantly approving new institutions that lack adequate resources.

- Learning From Others: Nigeria can also learn from established international student loan models (like those in the UK or USA). We should adopt best practices for efficient disbursement, transparent management, and fair repayment, including clear ways of managing loan defaults, that fit our own context.

Conclusion: The Stakes Are High for the Student Loan Scheme

NELFUND is a critical opportunity to invest in Nigeria’s greatest asset—its people. Letting this student loan scheme fail due to corruption and inefficiency, like other promising initiatives before it, would be a massive setback for countless students and the country’s development.

The administration must show unwavering commitment. This means tight oversight for NELFUND, absolute transparency, and zero tolerance for corruption. Protecting the integrity of the student loan program isn’t just about dollars and naira; it’s about safeguarding educational opportunity and maintaining public trust. Anyone caught sabotaging this vital scheme must face real consequences.