Bitcoin has continued to surge in popularity and value, with the world’s most well-known cryptocurrency rallying nearly 70% so far this year. Despite initial skepticism and uncertainty surrounding its legitimacy, Bitcoin has established itself as a mainstream investment option and a store of value.

Its decentralized nature and limited supply have made it an attractive alternative to traditional fiat currencies and a hedge against inflation. In this article, we will explore the factors driving Bitcoin’s recent price movements, its potential as a long-term investment, and the risks and benefits associated with investing in cryptocurrencies.

If you’re curious about why I still believe in cryptocurrencies, I’d love to share my thoughts with you. I’ve been pretty spot-on with my predictions about crypto, so feel free to check out my previous articles for proof!

Last year, I noted that the fluctuations in crypto had been just a temporary blip on the radar. The truth is, the economic tensions between the US and Russia (stemming from the Ukraine invasion) had ripple effects throughout the world. This included significant disruptions in the futures markets for commodities like grains, especially since a large portion of the world’s wheat exports come from Russia and Ukraine.

But here’s the good news: I believe that crypto is well-positioned to weather these storms. It’s precisely because of its decentralized nature that it can remain resilient even in the face of geopolitical tensions and sanctions (like the ones imposed on Russia through Swift). So let’s keep an eye on this exciting space and see where it takes us!

It’s important to note that the economic tensions I mentioned earlier didn’t just impact the crypto market – they affected the stock market as well, particularly technology-related stocks in the NASDAQ. Companies like Facebook, Apple, Amazon, and others took a hit.

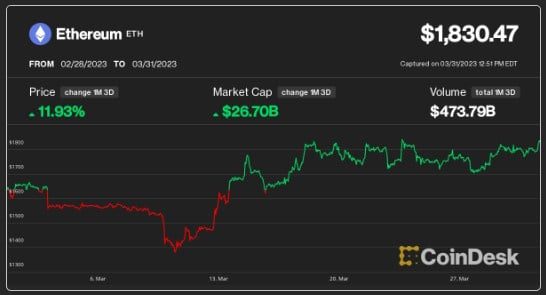

However, the market is now beginning to correct itself, and we’re seeing steady increases in the value of cryptocurrencies. Take a look at the CoinDesk widget below, which shows the rising price of Bitcoin.

If you had invested in Bitcoin just two weeks ago, you could have made a considerable profit – the value has gone up by about $6000, from $22,000 to $28,400.

And Ethereum is doing even better. They’ve recently launched a layer-2 network that’s generating a lot of excitement in the crypto community. This new network offers a low-cost, secure, and developer-friendly environment for building decentralized apps (DApps) on the Blockchain.

All in all, there are many reasons to be optimistic about the future of cryptocurrencies. With developments like these, we can look forward to a world where decentralized technologies play an increasingly important role in our daily lives.

It’s amazing to see that over 1 billion people are now using cryptocurrencies, which is a significant percentage of the world’s population. And according to statistics, India’s crypto population is set to increase to 158 million by the end of this year.

Another reason why people are turning to crypto is that it’s incredibly safe. Unlike traditional currencies, crypto is not subject to the whims and caprices of a government. We’ve seen how government actions can affect traditional currencies like the dollar, and even crypto to some extent. However, crypto is becoming increasingly stable and is now largely immune to government intervention.

The main reason I’m so optimistic about the future of crypto is that it’s here to stay. The days of the dollar as the world’s currency are numbered. 10 years ago, 70% of all central banks held their reserves in dollars. Today, that number has dropped to just 60%. And we’re seeing more and more countries moving away from the dollar and towards other currencies, such as the Chinese yuan.

But the good news is that crypto is largely unaffected by these changes. It has taken steps to protect itself from government intervention, and we’re now seeing central banks even creating their own cryptocurrencies. The Bank of Canada has already done it, and even Nigeria has launched its own version of cryptocurrency, the eNaira.

So, as we move forward, I believe that crypto will continue to grow and become an increasingly important part of our financial landscape. And I’m excited to see what new developments will arise in the coming years.

Presently, some of the best cryptos out there, like Bitcoin, Ethereum, Shiba Inu, and Dogecoin, are on the rise. In actuality, Bitcoin has increased from $22,000 to $28,400 in just two weeks, and I have a hunch it may reach $40,000 in the upcoming two months. This is just my opinion and not financial advice.

Contents

Tactics for Investing in Bitcoin and Ethereum’s Booming Market

If you’re thinking of investing, I suggest sticking to the good ones like Bitcoin and Ethereum instead of going for too many Altcoins. Once you’ve invested and the value starts going up, you could get some equity of 15 to 20% on your investment. Consider leveraging platforms like UpMarket, which can provide valuable insights and tools to maximize your trading potential. And don’t forget to sell once you get your principal amount back and keep trading with your profits. That way, if things go wrong, you won’t feel too bad because you’ve already made a profit.

Recommended: Binance Sign-Up Bonus: Refer Friends and Get a $100 Cashback Voucher Each

However, it’s important to note that investing all your money in crypto for years is not a wise decision. It’s always better to diversify your portfolio and invest in the top cryptocurrencies like Bitcoin and Ethereum, which have proven to be reliable and stable over time.

Coinbase is also one of the top digital currency exchanges and is one of the most popular places for people to buy Bitcoin (BTC), Ethereum (ETH), and other coins.

You can start off by registering an account at https://www.coinbase.com. If you’re feeling generous and/or want an extra NGN 4,610.33 in Bitcoin, register using https://coinbase.com/join/I7UWLL (This is a referral link that will give both of us NGN 4,610.33 when you buy or sell NGN 46,103.33 or more on Coinbase!).

So, my advice to you, and please remember, it’s just my opinion and not financial advice, is to invest in Bitcoin and Ethereum, and sell your investments once they increase in value. This way, you can secure your principal amount and trade with your profits.

I believe that cryptocurrencies are here to stay, and with the increasing adoption rate and protection against governmental interference, it’s a promising investment opportunity.

For instance, when Iran was banned from SWIFT, this couldn’t happen with crypto, regardless of political differences. With crypto, such actions are impossible. This shows that the world is gradually shifting towards cryptocurrencies and moving away from fiat currency, and I believe nothing can stop this trend.

Conclusion

Investing in Bitcoin and Ethereum can be a profitable venture if done with the right tactics. By focusing on buying the best cryptocurrencies and selling when you’ve made a significant profit, you can maximize your profit potential in the booming market.

Keep an eye on market trends, use reputable exchanges, and don’t invest more than you can afford to lose. With these tactics, you can navigate the volatile crypto market and potentially see a significant return on your investment. Remember, always do your research and make informed decisions to maximize your profit potential in the world of crypto.

If you have any questions, feel free to drop them in the comment section, and I’ll do my best to answer them.