Nigeria’s crackdown on cryptocurrency access, including Binance, underscores the complex relationship between digital assets and the Naira’s instability. While Binance emphasizes its commitment to regulatory compliance, allegations of market manipulation on its peer-to-peer (P2P) platform are raising serious concerns. This investigation exposes the alleged tactics employed by influential Binance P2P merchants and their potential role in exacerbating the Naira’s decline.

Contents

Binance P2P: A Tool for Manipulation?

Reports of Binance P2P manipulation involve the creation of deceptive ads on the platform offering to buy Tether (USDT) at grossly inflated rates, far above the prevailing parallel market prices. These ads, often featuring unrealistic minimum transaction limits, appear designed to artificially inflate the perceived Naira-to-USD exchange rate on P2P marketplaces.

This alleged distortion creates a ripple effect:

- Price Impact: Speculative buyers are drawn to unrealistic prices, potentially driving demand for USD on the parallel market.

- Benchmark Manipulation: Bureau De Change (BDC) operators may leverage this artificial P2P pricing as a benchmark, fueling Naira depreciation despite a lack of genuine demand.

The Mechanics of Manipulation: A Breakdown

Let’s illustrate the mechanics of this alleged scheme:

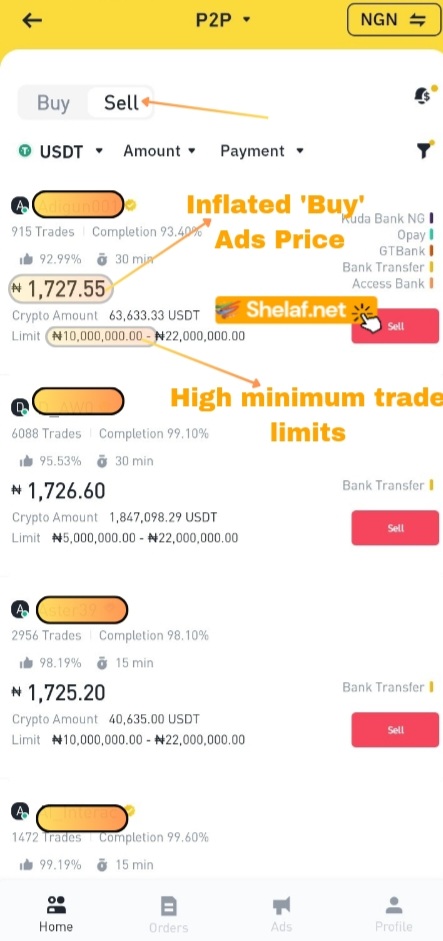

- Inflated ‘Buy’ Ads: A group of substantial Binance P2P merchants posts “buy” ads for USDT at a rate like N1,720 per dollar, significantly higher than the parallel market rate of N1,500.

- Filtering Sellers: These ads incorporate high minimum trade limits (e.g., over N10 million), deterring most average sellers.

- Manipulated Market Perception: The inflated “buy” ads dominate Binance P2P, creating an illusion of a higher Naira-to-USD exchange rate.

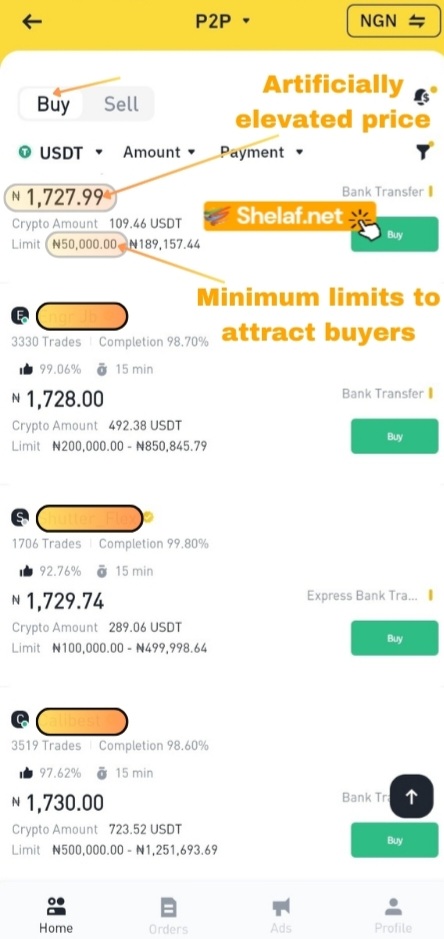

- Exploiting Buyers: These merchants then switch to selling USDT via “sell” ads at an artificially elevated price. Unlike the “buy” ads, they use lower minimum limits to attract buyers.

The Ripple Effect: From Binance to BDCs

The consequences of this P2P manipulation extend far beyond the platform:

- BDC Price Gouging: BDCs potentially adopt the inflated P2P rates as a benchmark, selling dollars to the public at excessively high prices while refusing to buy dollars at rates reflecting actual demand.

- Exacerbated Naira Depreciation: This price discrepancy fuels the perception of a weaker Naira, further driving its decline.

- Official Rate Adjustments: In response to the widening gap between official and parallel market rates, the Central Bank of Nigeria (CBN) may be forced to adjust official exchange rates upward, potentially perpetuating the cycle.

The CBN’s Conundrum

The alleged Binance P2P manipulation exposes a significant blind spot in the CBN’s oversight of the BDC system. Tackling this issue requires:

- Market Monitoring: Increased scrutiny of P2P exchange platforms for signs of price manipulation.

- BDC Accountability: Stricter enforcement of BDC regulations, ensuring they do not exploit artificially inflated P2P rates.

- Supply-Side Intervention: The CBN may need to intervene more directly in the foreign exchange market to counter speculative pressures. Additionally, making dollars more readily available through official banking channels for legitimate customer needs would reduce reliance on the BDC sector, minimizing their potential for price manipulation.

Conclusion

The Naira’s depreciation is a multifaceted issue driven by both fundamental economic factors and unscrupulous market practices. The alleged price manipulation on Binance P2P adds a worrying new dimension to the problem. Greater regulatory vigilance and cooperation between the CBN and digital asset platforms are crucial to restoring confidence and stability in the Nigerian currency market.

Disclaimer: This analysis is based on available information and allegations. It’s important to seek out multiple perspectives and consult with financial experts before making any investment decisions.