Have you ever felt that knowing every code and number in today’s digital world was impossible? For many Nigerians, the BVN is one of those easily forgotten yet critical bits of knowledge. If you’ve ever had trouble recalling your MTN BVN, you’re not alone! But don’t worry; this guide will be your one-stop shop for everything related to how to check BVN on MTN.

Contents

What’s the issue with BVNs, anyway?

Before we dive into the nitty-gritty, let’s take a quick step back. Your BVN (Bank Verification Number) is like a secret handshake between your bank accounts and your National Identification Number (NIN). This unique 11-digit code adds an extra layer of security to your financial transactions, making it much harder for fraudsters to steal your hard-earned cash.

Here is why having your BVN ready is a good idea:

- Security Boost: Think of your BVN as a lock on your bank account. It makes it much trickier for anyone who is unauthorized to access your funds.

- Smoother Transactions: BVNs help streamline various financial processes, from opening a new bank account to applying for a loan. No more mountains of paperwork!

- Reduced Fraud: By linking your BVN to your accounts, it becomes easier to track and prevent suspicious activity. Like a financial watchdog!

Knowing how to check BVN on MTN empowers you to take control of your finances and navigate the digital world with confidence.

Why check your BVN on MTN?

There are a few reasons why you might need to check BVN on MTN. Here are some frequent scenarios:

- Memory Lapse Strikes Again: Our brains can only hold so much information, right? If your BVN has slipped your mind, checking it on MTN is a quick and easy way to jog your memory.

- Verification Issues: Many banks and internet platforms need BVN verification before processing transactions. Having your BVN on hand ensures a smooth and speedy experience.

- Double-checking: To be safe, make sure your BVN is linked to the proper MTN phone number you’re using. Better safe than sorry!

Knowing how to check BVN on MTN gives you the ability to take charge of your finances and traverse the digital world with confidence.

How to Check BVN on MTN (The Easy Way)

Now that you understand the significance of your BVN, let’s go to the fun part—retrieving it! Here is what you should do:

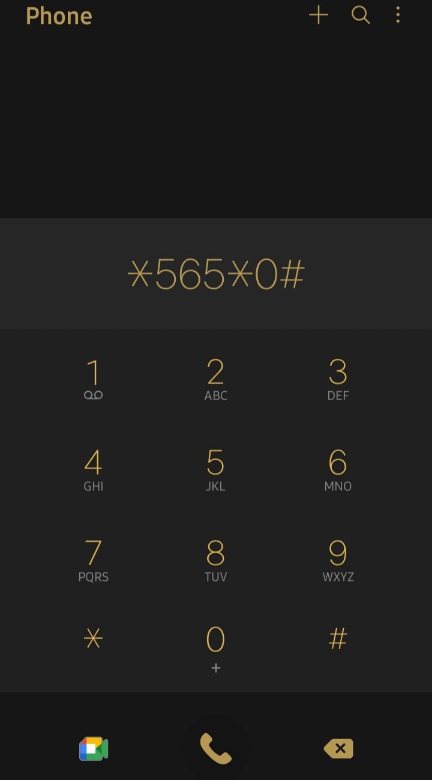

- Dial the Magic Code: Grab your phone and open the dial pad. Now, punch in the code *565*0#. This is the special USSD code for checking BVN on all Nigerian mobile networks, including our good friend MTN.

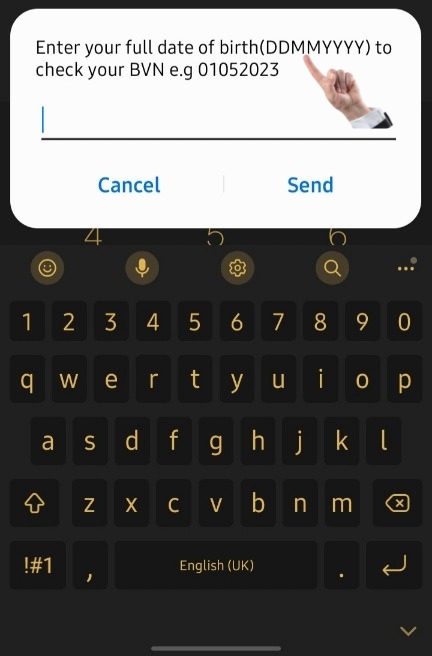

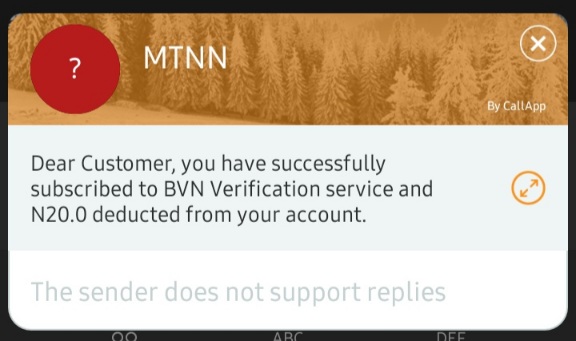

- Confirm by entering your full date of birth: Once you dial the code, a message will appear on your screen. This message will typically ask you to enter your full date of birth (in DDMMYYYY format) for confirmation. Note that a small service charge (around N20, but this can change) will be deducted from your airtime.

- Behold! Your BVN: After entering your date of birth for confirmation, your 11-digit BVN will be displayed on your phone screen in all its glory. Just make sure you have enough airtime balance (at least N20) to cover the service charge before you proceed.

Recall: Avoid falling for phony USSD codes or requests via email or text message for your BVN. These could be scams! Always use the official code and only share your BVN with trusted sources like your bank.

Alternative Methods to Check Your BVN (Beyond MTN)

While the USSD code approach is the most typical way to check BVN on MTN, there are a few additional alternatives to consider:

- Your Bank’s App or Website: Many Nigerian banks enable you to check your BVN via their mobile applications or websites. If you’ve already signed up for your bank’s online services, this might be a useful option.

- NIMC Mobile App: The National Identity Management Commission (NIMC) provides a mobile app that allows you to get your NIN and maybe your connected BVN (depending on the app’s features).

Keep in mind: These alternative methods might require login credentials or internet access.

Understanding USSD Codes and Service Charges

USSD (Unstructured Supplementary Service Data) codes are useful, tiny codes that can be entered into your phone to access various mobile network services. The *565*0# code to check BVN on MTN is standardized and applies to all Nigerian networks. Think of it like a secret language between your phone and the network!

Here’s a heads-up about service charges: Using USSD codes for certain services, like checking your BVN, often comes with a small fee. In the case of checking your BVN on MTN, the current charge is N20 (subject to change). This fee is deducted from your MTN airtime balance.

Some extra tips to remember about USSD codes:

- Double-check the fee: Before using a USSD code, it’s always wise to see if there’s a service charge involved. This information is normally displayed on your phone’s screen when you dial the code.

- Beware of imposters. Stick to the USSD codes from trusted sources, such as your mobile network operator or bank. There are fraudsters out there who may attempt to fool you into using phony codes to steal your airtime or personal information. Do not fall for it!

Case Study: The Power of Knowing Your BVN

Imagine this: Ngozi, an MTN subscriber, needs to send some money urgently to her sister for an unexpected medical bill. She decides to use a mobile money-transfer service. But the plot twist! During the transaction, Ngozi is prompted to enter her BVN for verification. Uh oh, Ngozi can’t remember her BVN for the life of her!

This situation could cause a major delay and frustration for Ngozi. However, if Ngozi knew how to check BVN on MTN using the *565*0# code, she could have retrieved her BVN quickly and completed the money transfer without any hassle.

This example highlights why having your BVN readily available is a smart move. It can save you precious time and ensure a smooth experience when dealing with financial transactions.

Security Matters: Protecting Your BVN

While checking your BVN on MTN is a breeze, security should always be a top priority.

- Your BVN is a top secret: Treat your BVN with the same care as you would your ATM PIN. Never reveal your BVN to anybody, including friends, relatives, or anyone purporting to be from your bank, over the phone or by email.

- Phishing scams: be cautious! Scammers may attempt to fool you into disclosing your BVN using phishing emails, text messages, or phony websites. Be wary of unsolicited emails asking for your BVN. Only share your BVN with reputable sites or directly with your bank.

- Phone security is essential: Make sure your phone is locked with a strong PIN or password. This prevents unwanted access to your BVN if your phone is lost or stolen.

By following these security best practices, you can minimize the risk of fraud and keep your financial information safe and sound.

Conclusion: Be Informed and Secure with Your MTN BVN

In today’s digital age, protecting your financial transactions is critical. This post has given you information on how to check BVN on MTN using the USSD code 5650#. Remember that your BVN is strictly secret. Treat it with the same care as your ATM PIN, and never disclose it to anybody.

By adhering to the security best practices stated above, you can keep your BVN safe while still making it easily available for authorized financial activities. You’re now ready to be a financially empowered and educated MTN user!