Cryptocurrency trading is now really popular, with billions of dollars worth of coins being bought and sold every day. The “lucky” ones have made a serious amount of money doing this, and there are lots of people that are now trading cryptocurrency as a full-time job.

Bitcoin continues to stand out as truly newsworthy. Established in 2009, it was once worth pennies. Presently it’s outperformed $55K. Other cryptocurrencies such as Ethereum, have likewise hit record-breaking highs.

As the main cryptocurrency has arrived at a gigantic achievement this month, outperforming $55,812, the novices keep thinking about whether bringing in cash with Bitcoin is as yet conceivable. Increasing multiple times in size since a year ago’s March crash, the main digital asset figured out how to outflank everybody’s assumptions. After all that development, is there truly space for additional?

Notwithstanding the way that even the most experienced dealers are presently terrified that Bitcoin is overflowing, we are both in a general sense and actually in a decent spot. If we compare network statistics from 2017 (like charges, tx speed, network clog, and so forth) to what we have today, it turns out to be evident that the continuous bull run is no place near arriving at the euphoric state from four years prior.

Cool fact: In December 2017, for the first-ever time, more than $50 billion of cryptocurrency was traded in just one day!

There’s no doubt that cryptocurrency is an exciting market for investors, but unfortunately, success doesn’t happen as easily as that. In all seriousness, cryptocurrency trading can be a risky business. Yes, it’s true — some people have made lots of money. However, some people have lost lots of money too.

For those of you who are interested in learning about cryptocurrency trading, I’m here to help you get started. This guide is going to show you everything you need to know. Am making this guide free of charge for our esteemed customers and followers that are Cryptocurrency enthusiasts and would like to venture into its trading.

This guide isn’t a bring-in cash venture management that promotes Ponzi schemes or platforms that guarantee high investment returns after a time frame, utilizing reference rewards to select and scam naïve individuals. This is a guide on how the Cryptocurrency market functions, how you can use the market, how you can trade on various Cryptocurrencies, and perhaps make a king’s ransom by doing that.

Trading Cryptos in layman’s language simply means buying some Cryptocurrencies when the cost is moderately low and selling them when it’s high, you can call it storing of coins.

However, experienced traders use lots of different tools like Signals – Crypto, Blockfolio, Bitcoin Checker, zTrader, Cryptonator, etc., to help them pick the right coins at the right time. This can include software that helps investors analyze previous pricing trends etc.

Nevertheless, everyone must start somewhere! As long as you are not trading more than you can afford to lose, there is no harm in giving it a try.

Now, I will explain what short-term trading is, along with its advantages and disadvantages.

Contents

Short-term Trading

Short-term trading is where you buy a cryptocurrency but only plan to hold on to it for a short amount of time. This can be anything from minutes, hours, days, weeks, or even a few months!

You might buy a certain cryptocurrency because you think it will rise in price in the short term. In which case, you would then sell it for a quick profit if you thought the price was going to drop again!

Let’s look at some of the advantages of short-term trading.

Advantages

The main advantage of short-term cryptocurrency trading is that it offers a really good opportunity to make high percentage gains. Unlike fiat currency markets, where prices usually don’t move by more than 1% each day, cryptocurrency prices can almost double overnight!

Now that cryptocurrencies have become so popular, there are now more than 1,500 different cryptocurrencies to trade. This means one thing — more opportunities to make huge profits. Not only that, though, but there are large trading volumes for lots of coins.

Large trading volumes are important as it means you will always find a buyer or seller! It simply means that a high amount of currency is flowing in and out of that cryptocurrency.

Disadvantages

As the cryptocurrency markets are so volatile, the prices can change very quickly. This means that if you want to perform short-term crypto trading, you will need to spend a lot of time analyzing the markets.

It’s super important to keep in control of your emotions — one thing you will learn when short-term trading is that you don’t always win. It can be very stressful when prices move differently from how you had hoped.

So, learning to accept losses is a big part of cryptocurrency trading. Nobody makes profits 100% of the time!

Short-term cryptocurrency traders look for small gains in small price movements, so you will need to have quite a good analytical ability. This means being able to read trading charts and graphs. Which, if you are a beginner, can take a little while to learn.

Another disadvantage of short-term trading is that, for you to see good returns, you must make quite a large investment. Which is something that most of you beginners might not feel comfortable with.

Long-term Trading

Have you ever heard the word “HODL”? Well, if not, then we’ll assume you’re completely new to the crypto space! No, it’s not a word you’ll find in the dictionary, but you’ll certainly find it in crypto forums and community chat groups!

“HODL” is a slang word meaning to hold a cryptocurrency long term (refuse to sell an investment despite drops in value that might scare other investors into selling) rather than selling it. Its actual meaning is “Hold On for Dear Life”. Usually, long-term crypto trading means holding a coin for one year or more.

The idea is that, although there will always be volatility, the price should increase in a large amount over the long term.

A great example of this would be the lucky investors who bought Bitcoin in 2011 when it was just $0.35. If they held on to it until late 2017, they could have sold their coins for almost $20,000 each! That’s over 57,000X your initial investment!

Advantages

One of the main advantages of long-term cryptocurrency trading is that it’s easy and requires a little amount of time. You don’t need to understand complex trading charts or graphs as you’re simply looking to hold your coin for the long term.

Unlike short-term trading, where you need to constantly spend time checking the prices of cryptocurrencies, you can do it in your spare time. It’s simple, once you have bought your coin, you don’t need to do anything other than wait!

Another good advantage of long-term cryptocurrency trading is that you don’t need lots of money to get started. You can buy small amounts whenever you have some spare money, and let it grow over a long period of time.

This also allows you to avoid the stresses of market volatility, as you don’t need to worry about short-term movements in price.

Disadvantages

One disadvantage of long-term cryptocurrency trading is that you might miss a good opportunity to make quick short-term gains.

Sometimes coins rise in value really quickly, only to fall straight back down. Short-term traders will notice this and can make a quick profit.

Another disadvantage is that because you aren’t spending time analyzing the market (as much as a short-term trader), you could miss some bad news. If there is bad news released that could affect the price of your cryptocurrency (such as regulations), the price could fall and never rise again.

So, just make sure you are keeping on top of cryptocurrency news to avoid this from happening.

Now that you know some of the advantages and disadvantages of both short and long-term cryptocurrency trading, let’s have a look at some of the things you need to be careful of before you start and the materials needed.

What to be careful of?

The most important thing to remember before you start trading is that there is a chance you could lose your entire investment.

The cryptocurrency markets are very volatile, and although some people have made lots of money, lots of people have lost money too. You should never trade with any amount that you can’t afford to lose.

How you deal with your losses will determine your success as a trader. Here’s some important advice — never try to earn your losses back by investing larger amounts. This is investing with emotions and often causes people to lose a lot of money.

Materials needed to trade cryptocurrency

Before venturing into cryptocurrency trading you need to have some tools or resources that will enhance and facilitate the process this includes:

- An Android or iPhone or PC

- A Cryptocurrency Wallet, for receiving, sending, and storing your Cryptocurrencies.

- An exchange platform, for selling and buying Cryptocurrencies.

- Updated Cryptocurrency Coins and tokens Analysis and Tips

If you have read our guide so far, you should now have a good understanding of what cryptocurrency trading is, the difference between short-term and long-term trading, the things you need to be careful of and the materials needed.

Guess what? It’s now time to learn how to trade crypto!

How to Start Trading

As you are looking to trade cryptocurrencies, the first thing we need to do is get you some coins! Some Cryptocurrencies and tokens’ esteem go from $0.0000539 to $1 and are expanding in esteem each day. Presently, on the off chance that you can purchase a great many of these Crypto coins, crowd them for certain weeks or months and sell them when the worth is high, you will make a decent profit from investment within a couple of weeks, months or years as the case may be, some cryptocurrencies can grow by up to 100% to 10000% percent within a couple of weeks or months.

To invest and make a profit from Cryptocurrencies, most especially, Short-term Trading. We need to answer some questions.

The questions we need to attend to, are:

1. How Can I know the appreciated coins and tokens?

2. How do I buy and sell these coins swiftly and easily?

3. How do I store these coins?

1. Have a Multi-Cryptocurrency wallet

To start trading Cryptocurrency and know the appreciated coins and tokens, you need to have a multi-cryptocurrency wallet for storing, sending, and receiving those coins and tokens, we already have a list of the best cryptocurrency wallet where you can store multiple cryptocurrencies, click here to view them and download any of them.

2. Perform Cryptocurrency Analysis and Due diligence

The ultimate thing is having an idea of the coins that are worth little cents now and are constantly increasing in value, most people charge to give out this kind of information, but we @ Shelaf.net will give you that information free of any charge, there are two ways to achieve this:

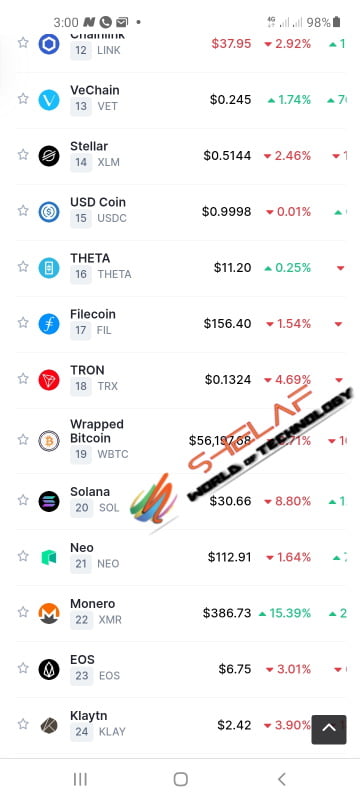

A. Using CoinMarketCap to Ascertain the Ranking, Value, and Price Changes of some Cryptocurrencies

Coinmarketcap.com is a cryptocurrency analysis website, that has all the information regarding any Cryptocurrency, the price changes, the ranking, the market capitalization, etc., if a coin is listed on coinmarketcap, it means that the coin has been recognized globally and can be traded on.

So here is how you can use coinmarketcap to perform your Crypto hunt and research to ascertain the top-performing Cryptocurrencies, their value, and the price changes over a specific period of time.

Note that you should be more interested in Cryptocurrencies that are worth some cents, with good ranking and marketing capitalization

- To do that, visit Coinmarketcap.com, you will see the list of top-ranked Cryptocurrencies of which Bitcoin is the number 1.

- Then scroll and look for other top-ranked coins, that are still worth some cents $0.xx

- Select any of them, then scroll through the page and check its price changes below the chart option, you can check the 24 hours, 7 days, 30 days, 90 days, or all-time price change of the coin.

With that information, you will ascertain if the coin is actually doing well or not

B. Using a Multi-Cryptocurrency wallet to ascertain the price, Ranking of Cryptocurrencies

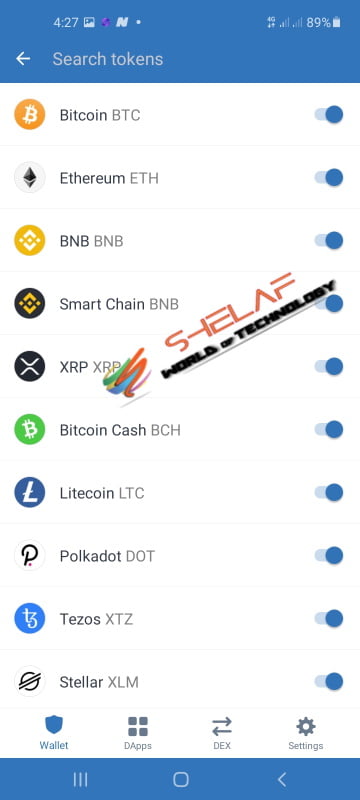

You can use any of the Multi-Cryptocurrency wallet apps that we shared earlier to ascertain the price changes of some Cryptocurrencies, for this guide we will be using the Trust wallet, if you have the trust wallet app, go to the app settings and add as many different Crypto coins to your portfolio.

- To do so, click on the Settings icon on the home page

- Then Tick as many Crypto coins and tokens to add them to your portfolio

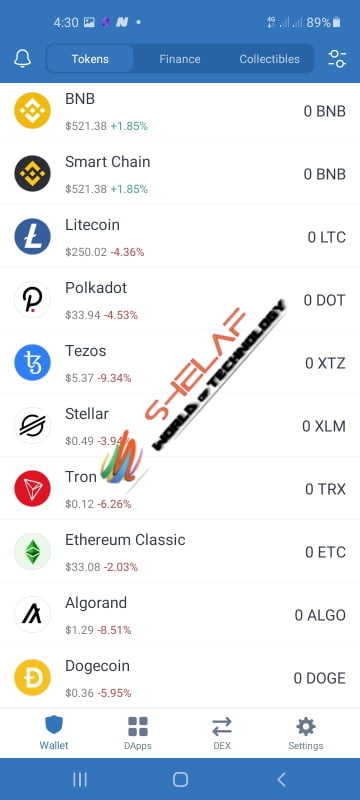

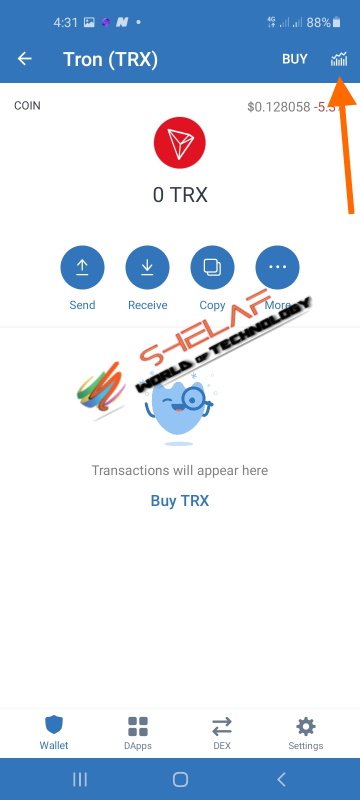

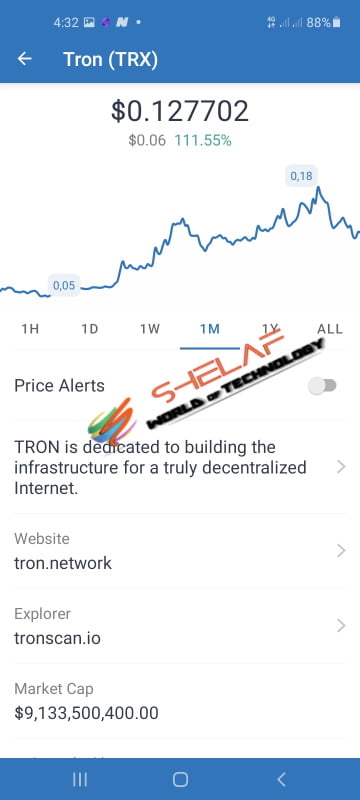

- Now that you have those coins, you need to go through them and look for the Cryptos that value some cents, $0.xx, we will be using Tron for example

- Click on the coin and check its growth within a specific time frame, a day, weekly, monthly, yearly, etc.

This will show the percentage growth the coin attained within any of the time frames, if it looks promising, then you should consider buying bulk some of that coin

You can still buy coins that worth hundreds or thousands of dollars like Bitcoin, Ethereum, BNB, etc, what matters here is that the coin grows constantly over time and not stagnant.

C. An Exchange Platform to buy, sell Cryptocurrencies

Your work is not fully done until you are able to buy those coins because not every exchange out there supports some of those Cryptocurrencies, so you need to make use of a swift and trusted Cryptocurrency exchange platform like Binance, Remitano and others that supports those coins that you will want to hold, this is very vital, because that’s how you can be able to buy those coins with your local currency, and equally sell the coins and get paid in your local currency too whenever you want to withdraw your coins/profits.

Once more, let me remind you: Cryptocurrency fluctuates in nature, and trading in Cryptocurrency involves some sort of risk, it’s very important that you know that, also a coin can grow by 1000% this week and depreciate the next week, just like any investment, while trading Cryptocurrency use money that you don’t need sooner, I mean your spare money.

Conclusion

This is the end of our Cryptocurrency trading guide — we hope that you enjoyed it!

If you have read this article from start to finish, you should now have a good understanding of what crypto trading is, the difference between short-term and long-term trading, and some important things to consider before you get started.

Not only that, but you now know how to make your first crypto purchase and how to trade between different cryptocurrencies! Just remember, you should always speak to a financial advisor before placing any investments and always do your own research.

So, how did you find the guide? Have you purchased your first cryptocurrency? Do you have any ideas of which cryptocurrency you’re going to start trading?..

Let us know via the comment section below!