All deposits made into clients’ Kuda accounts that total N10,000 or more will henceforth be subject to a N50 fee by Kuda Bank.

The bank informed its clients by mail that this was in accordance with the Federal Government’s stamp duty laws.

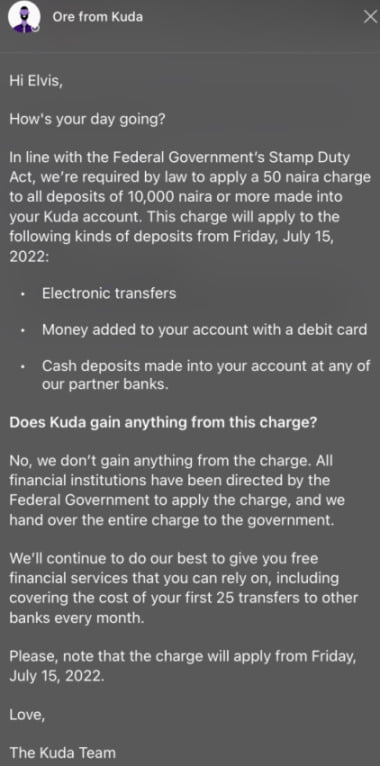

“In line with the federal government’s duty act. We‘re required by law to apply a N50 charge to all depositors of N10,000 or more made into your Kuda account. This charge will apply to the following kinds of deposits from Friday, July 15, 2022; electronic transfer, money added to your account with a debit card and cash deposits made into your account at any of our partner banks.”

In the email, Kuda bank stressed that they don’t get to keep anything from the charges that all the charges are remitted to the government.

“We don’t gain anything from the charge. All financial institutions have been directed by the federal government to apply the charge, and we hand over the entire charge to the government.

The updates will be effective as of July 15, 2022.

Note: Your first 25 transfers remain free of charge, however, after that, there will be fees.

Customers, however, have expressed their displeasure with the new form from the bank of the free to the bank of the charge on social media in response to the news. What are your thoughts on this?