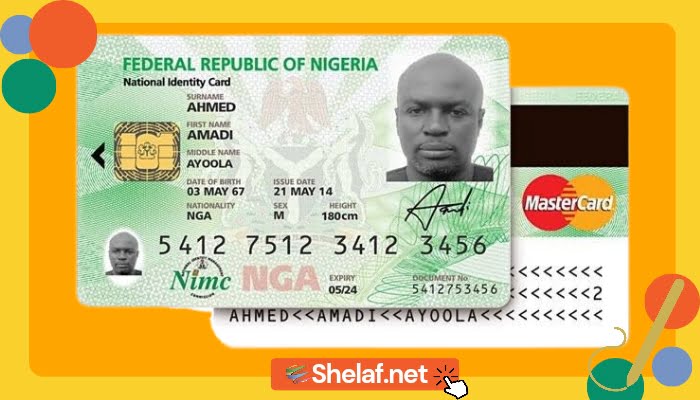

In a significant move towards empowering Nigerian citizens and enhancing access to essential services, the Federal Government has granted commercial banks the authority to issue multipurpose National Identity Number (NIN) cards at no extra cost.

This groundbreaking decision, approved at a Federal Executive Council (FEC) meeting, follows a memo from the National Identity Management Commission (NIMC) that permits banks to print debit cards that also function as official national identity cards.

Expanding the scope of traditional banking services, the NIN cards will revolutionize the way Nigerians interact with financial institutions and government agencies.

The Minister of Communications and Digital Economy, Prof. Isa Pantami, unveiled this development in Abuja, emphasizing the dual functionality of the card. Not only will it serve as a national identity card but also as a versatile bank card compatible with renowned payment networks such as Mastercard and Visa.

Contents

The Liberating Potential of Multipurpose NIN Cards

1. The Role of NIN and the Optional Card:

The NIN, a unique identification number, has been a mandatory requirement under the NIMC Act 2007 for all Nigerian citizens and legal residents. While the possession of a physical national identity card has been optional, citizens have increasingly expressed a desire for this tangible proof of identification, even though the Act only stipulates the acquisition of the NIN itself.

This demand has been particularly prominent among citizens residing in rural communities, who face challenges accessing digital alternatives like the smart ID card available through the NIMC app.

2. Streamlining the Process with Multipurpose Cards:

To address these concerns and streamline the process, NIMC partnered with the Central Bank of Nigeria to allow citizens to request a multipurpose NIN card through their respective banks. This collaboration presents a groundbreaking solution, offering citizens the convenience of a single card that serves both as a national identity card and a bank card. By integrating these functions, citizens can effortlessly engage in financial transactions while fulfilling their obligation to possess a national identity card.

3. Benefits and Practicality:

The introduction of multipurpose NIN cards brings numerous benefits to Nigerian citizens:

- Convenience and accessibility: With the card acting as a dual-purpose instrument, citizens no longer need to carry separate bank cards and national identity cards. This amalgamation simplifies their daily lives, reducing the number of cards they must manage.

- Financial Inclusion: Multipurpose NIN cards enable individuals, particularly those in rural areas, to access banking services conveniently. With increased financial inclusion, citizens can leverage various banking facilities and engage in digital payment transactions, contributing to economic growth and empowerment.

- Cost Savings: The issuance of multipurpose cards at no additional cost alleviates the financial burden on citizens. It eliminates the need to pay for separate bank cards and national identity cards, making essential identification services more affordable and accessible.

4. Ensuring Privacy and Confidentiality:

To safeguard the privacy and confidentiality of cardholders, NIMC and the Central Bank of Nigeria have signed a nondisclosure agreement. This commitment ensures that personal information shared during the card issuance process remains secure. Through a seamless online application process, banks verify the applicants’ records in the NIMC database, protecting their data and upholding their privacy rights.

Streamlining NIN-SIM Integration for Enhanced Efficiency

1. Introduction of an Automated System:

In addition to the introduction of multipurpose NIN cards, the Federal Executive Council has approved the deployment of an automated system to integrate NINs with individual SIM cards. This system aims to consolidate the implementation of the NIN-SIM linkage, providing a streamlined process for SIM replacement and enhancing the accuracy of the database.

2. Simplifying the Process of NIN-SIM Integration:

The automated system for NIN-SIM integration is poised to revolutionize the way Nigerians manage their SIM cards. By linking NINs with individual SIM cards, the government aims to enhance service efficiency and streamline procedures for SIM replacement. This development comes as a response to the growing need for a robust and reliable identification system, particularly in the telecommunications sector.

3. Sanitizing the Database:

The implementation of the automated system will play a crucial role in sanitizing the database by ensuring that accurate and up-to-date information is associated with each SIM card. By linking the NIN to the SIM, the system will enable authorities to verify the identity of SIM cardholders more effectively, reducing the risk of fraud and unauthorized usage.

4. Enhanced Service Accessibility:

The integration of NINs with SIM cards will simplify the process for Nigerians who need to replace their SIM cards due to loss, theft, or damage. Previously, individuals had to undergo time-consuming procedures and provide various documents to obtain a replacement SIM. With the new automated system, the process will be expedited, ensuring that citizens can regain access to essential communication services quickly and conveniently.

5. Strengthening Security and Identification:

The integration of NINs with SIM cards aligns with the government’s commitment to enhancing security and combating identity-related crimes. By linking each SIM card to a verified NIN, the system will provide an additional layer of authentication, making it more challenging for criminals to use anonymous or fraudulent SIM cards for illegal activities. This development will contribute to creating a safer digital environment for all Nigerians.

6. Collaborative Efforts for Seamless Integration:

The successful integration of NINs with SIM cards relies on collaboration between government agencies, telecommunications service providers, and citizens. The government will work closely with telecommunications companies to ensure the smooth implementation of the automated system. Simultaneously, citizens will be encouraged to proactively link their NINs with their SIM cards, reinforcing the importance of this integration for enhanced security and improved service delivery.

Conclusion

The Federal Government’s decision to allow banks to issue multipurpose NIN cards and the introduction of an automated system for NIN-SIM integration mark significant milestones in empowering Nigerian citizens and streamlining essential services.

The multipurpose NIN cards, which serve as both national identity cards and bank cards, offer convenience, accessibility, and cost savings for individuals. By partnering with banks, the government aims to ensure that citizens across the country can easily obtain these cards and enjoy the benefits they bring.

Furthermore, the automated system for NIN-SIM integration addresses the need for a robust identification framework in the telecommunications sector. The system’s implementation will enhance security, streamline SIM replacement procedures, and strengthen the overall identification process. Through collaborative efforts, the government, telecommunications companies, and citizens can work together to achieve seamless integration that fosters a secure and technologically advanced Nigeria.

These initiatives exemplify the government’s commitment to leveraging digital innovations to empower citizens, promote financial inclusion, and enhance security. By embracing multipurpose NIN cards and automating NIN-SIM integration, Nigeria takes a significant step towards a more efficient and inclusive digital future.