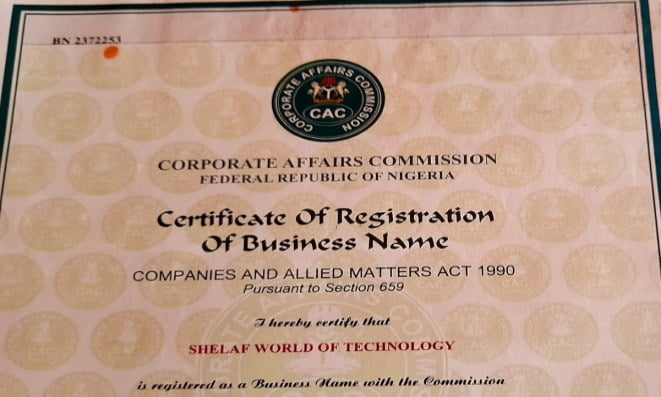

The Corporate Affairs Commission of Nigeria was launched in line with the Companies and Allied Matters Act (CAMA), promulgated in 1990 and amended in 2020. The commission is saddled with the responsibility of regulating how companies are formulated and managed in Nigeria.

Meanwhile, there are countless numbers of benefits you get when you register your business name with CAC.

And this includes:

- Opening a corporate bank account

- Online payment integration

- Social media account verification

- Protecting your brand name

- Protecting your legal liability

- Preventing police harassment

- Access to government loans

- Customer trust

- Government contracts

- Continuity of business

CAC Registration in Nigeria could be expensive if you involve a third party. Therefore, I want to show you the requirements and the fees to register your company in Nigeria, you don’t even need the service of an agent or visiting the commission.

This article will walk you through the process and make your business become a legal entity in simple steps.

With the use of the Corporate Affairs Commission online registration portal, you can register your business at a minimum cost.

It was stated on the official website of the commission:

Individual/Proprietors can register business names without the services of the legal practitioner, Chartered Accountant or Chartered Secretary.

Assuming you want to register your company and you give the job to a lawyer, you’ll be charged higher than the official rate.

As a result of this, most small business owners are discouraged from registering their businesses.

When you fail to register your business, the implication is that the business doesn’t exist. And in a situation like this, your business will lack credibility.

Laid out in this article are the 3 steps involved in registering your business or company’s name, and the fees that you need to complete the process.

Before you begin the process, you need to ensure that the business or company’s name that you intend to register hasn’t been registered by the CAC.

Recommended Article: How to Verify if a Business Name or Company in Nigeria is Legally Registered or Not

Contents

How do you go about CAC Online Registration?

It is easy, all you need to do is visit the website of the CAC to check if the name you want to register has not been incorporated.

Steps to take to register your business with the CAC

Step 1: Name Reservation

You can reserve your intended business name for a period of 60 days through the CAC’s name reservation practice.

Steps to take:

- Go to the website of the commission, here

- Sign up, if it’s the first time you’re going through the process or you could sign in if you have visited the website prior

- The next thing to do is reserve the business name you want by clicking on ‘Name Reservation’;

- Fill the form accordingly and pay what is required

- After that, give it 24 hours for confirmation from CAC, and if the process was successful, print out the ‘approval note’.

Reservation of the name cost N500, check the list of fees here.

To make that payment, you need to pay via Remita, by clicking the Remita button.

You’ll be automatically redirected to the Remita payment platform to complete the payment.

You don’t have to do anything other than click SUBMIT and do as prompted.

After the payment has been successfully made, your application for company or business name reservation would be submitted for approval.

Step 2: Pre-registration

This comes before incorporation, you just need to access the Registration area and Complete the pre-registration form – CAC-BNo1 and upload relevant registration documents – Online using the Company Registration Portal.

Here are the documents you need:

- Company details: type of business, registered office address, and email address of your company.

- Details of the first directors, at least 2 people above the age of 18 years: date of birth, name, phone number, gender, email address, identification documents (National ID, permanent voter’s card, driver’s license, or international passport).

- You’ll also need to disclose the percentage of shares to be held if the director is a shareholder in the company.

- Shareholders’ documents and details should include the following: date of birth, name, phone number, gender, email address, identification documents (National ID, permanent voter’s card, driver’s license, or international passport) and the shares to be held.

- Documents and details of the company’s secretary (they must be either a corporate body or an individual). Details should include the date of birth, name, phone number, gender, email address, identification documents (National ID, permanent voter’s card, driver’s license, or international passport).

- A legal declaration of compliance supplied by a legal person or body, as provided by CAMA (should be signed by a legal practitioner and attested to by a notary public or a commissioner for oaths).

- Documents of the Articles of Memorandum of Association. To help, there is a ready-made template of the Articles of Memorandum of Association.

- After filling out the form successfully, you will be prompted to make payments to facilitate the process. You will be asked to pay for CAC registration fees and stamp duty to the Federal Inland Revenue Service Fees (FIRS).

- After that is finished, you will need to take a printout of a completely filled and electronically-stamped form CAC 1.1 and the Articles of Memorandum of Association.

- Notarize the attestation pages and scanned copies of the signed documents.

Step 3: Uploading Documents for Incorporation

You would need to scan all your documents, and to do this, you will need to sign in to the portal.

Here are the documents you would be required to upload:

- Approval note/Availability printout

- Registration form CAC 1.1

- Identification documents of shareholders and directors

- Receipt of payment of your CAC

- Stamp duty certificate (print this out after the required fee has been paid)

- Memorandum and Article of Association

- Certificate of incorporation of the company’s secretary (this is needed only when the secretary is a corporate organization)

Note: all documents need to be generated in PDF format.

Your company will be registered incorporation in less than 48 hours, and you will need to pick up your documents in person at the CAC office.

Also Read: How to Obtain Tax Identification Number (TIN) Through Online in Nigeria

The Requirement for CAC Registration

- Name of business or company

- The goal of business

- Business memorandum and articles of association

- Document of authorized share capital

- Form CAC 1 and the reservation and availability of the proposed name

- Names and addresses of directors incorporating the company

- Two passport photographs (must be recent), and valid IDs

- Name and address of company secretary

- Declaration of compliance by a legal practitioner

- Address of the company

- Filings with the Federal Inland Revenue Service (FIRS) and

- Any and all documents required by the commission

CAC Registration Fees

| S/N | SUBJECT | FEES (N) |

| 1 | Reservation of Name | N500 |

| 2 | Registration of the private company with share capital of N1million or less | N10,000 |

| 3 | Registration of private company/Increase in Share Capital above N1million and up to N500million | N5,000 for every N1million share capital or part thereof |

| 4 | Registration of private company/Increase in share capital above N500million | N7,500 for every N1million share capital or part thereof |

| 5 | Registration of Public company/Increase in share capital | N20,000 for the first N1million share capital or part thereof |

| 6 | Registration of Public Company/Increase in share capital above N1million and up to N500million | N10,000 for every N1million share capital or part thereof |

| 7 | Registration of Public Company/increase in share capital above N500million | N15,000 for every N1million share capital or part thereof |

| 8 | Registration of Company not having a share capital | N20,000 |

| 9 | Filing of notice of exemption of foreign Companies from Registration | N30,000 |

| 10 | Re-instatement/Relisting of company name | N25,000 |

| 11 | Registration of charges for private company | N10,000 for every N1million or part thereof |

| 12 | Registration of charges for public company | N20,000 for every 1Million or part thereof |

| 13 | Filing of annual return for a small Company | N2,000 |

| 14 | Filing of annual return for Private company other than a small company | N3,000 |

| 15 | Filing of annual return for public company | N5,000 |

| 16 | Filing of annual return for company Limited by Guarantee | N5,000 |

| 17 | Filing of annual report by foreign companies | N5,000 |

| 18 | Filing of statement in form of schedule 14 under section 553 | N10,000 |

| 19 | Filing of notice of merger/acquisition | N50,000 |

| 20 | Filing of special resolution for merger | N20,000 |

| 21 | Filing of other documents relating to merger | N10,000 |

| 22 | Filing of statutory declaration of solvency | N5,000 |

| 23 | Registration of appointment of liquidator | N10,000 |

| 24 | Registration of resolution for winding up | N10,000 |

| 25 | Filing of return of final meeting and account of liquidation | N5,000 |

| 26 | Filing of notice of change of company name | N10,000 |

| 27 | Filing of notice of alteration of memorandum and articles of association | N5,000 |

| 28 | Filing of notice of changes in particulars of directors | N2,000 |

| 29 | Filing of return of allotment and or notice of change in shareholding | N2,000 |

| 30 | Filing of notice of change in registered address | N2,000 |

| 31 | Filing of notice of appointment of receiver | N10,000 |

| 32 | Filing of notice of discharge of receiver | N5,000 |

| 33 | Filing of notice of change of signature | N2,000 |

| 34 | Filing of notice of reduction in share capital by public company | N20,000 |

| 35 | Filing of notice of reduction in share capital by private company | N10,000 |

| 36 | Filing of deed of release by public company | N10,000 |

| 37 | Filing of the deed of release by private company | N5,000 |

| 38 | Application for extension of time for holding of annual general meeting by public company | N10,000 |

| 39 | Application for extension of time for holding of annual general meeting by private company | N5,000 |

| 40 | Letter of Good Standing | N10,000 |

| 41 | Other filings (miscellaneous) | N2,000 |

| 42 | Certified true copy of certificate of registration | N10,000 |

| 43 | Certified true copies of memorandum and articles of association | N3,000 |

| 44 | Electronic Search | N1,000per company |

| 45 | Manual Search by customers | N2,000per company file |

| 46 | Manual Search Report prepared by officers of the Commission | N5,000 |

| 47 | Certified true copies of other documents | N2,000per document |

| 48 | Consent for Restricted Names | N5,000Business Name |

| 50 | Reservation of Name | 500 |

| 51 | Registration of business name | 10,000 |

| 52 | Filing of notice of change of business name | 5,000 |

| 53 | Filing of notice of change in business address | 1,000 |

| 54 | Filing of notice of change in proprietorship | 1,000 |

| 55 | Filing of annual return | 1,000 |

| 56 | Filing of notice of cessation of business | 1,000 |

| 57 | Filing of other documents (miscellaneous) | 1,000 |

| 58 | Search on business name file | 1,000 per business name file |

| 59 | Certified true copy of business name certificate of registration | 5,000 |

| 60 | Certified true copies of other documents | 2,000 per document Incorporated Trustee |

| 61 | Reservation of Name | 500 |

| 62 | Incorporation of trustees | 30,000 |

| 63 | Filing of notice of change of name | 10,000 |

| 64 | Filing of notice of change in trustees | 10,000 |

| 65 | Filing of notice of amendment of constitution | 6,000 |

| 66 | Filing of annual return | 5,000 |

| 67 | Filing of notice of court order for dissolution of incorporated trustees | 5,000 |

| 68 | Filing of other documents (miscellaneous) | 1,000 |

| 69 | Search on incorporated trustees file | 2,000 |

| 70 | Certified true copy of certificate of incorporation | 10,000 |

| 71 | Certified true copy of constitution | 5,000 |

| 72 | Certified true copy of incorporation form | 2,000 |

| 73 | Certified true copies of other documents | 2,000 per document |

Conclusion

If it was your wish to know how to register your business name with CAC in Nigeria, I hope this guide would be of great help to you.

Most people didn’t want to register their businesses having consulted a lawyer and the bill was too much.

Meanwhile, the official fee of registering a company or business name isn’t costly.

As part of the effort of the government to create a sustainable economy for micro, small and medium enterprises (MSMEs) in Nigeria, the CAMA was amended last year.

Consequently, some of the requirements to register a business or company in Nigeria have been simplified. It’s now possible for you to register your company online using the CAC online registration portal.

With such a new development, you should be able to register your business in Nigeria by yourself at a very low cost.