In a country like Nigeria, making online purchases, especially when payments are in dollars, can be a considerable challenge. Many individuals, including our online friends, have encountered this issue. Today, I’m here to present a solution – a comprehensive guide to acquiring International Bank Accounts and Debit Cards that enable Nigerians to seamlessly make online payments for goods from around the world.

Nigeria’s online shoppers face a unique set of hurdles due to regulations imposed by the Central Bank of Nigeria (CBN). The nation operates dual exchange markets with distinct rates, which, as of October 20, 2023, reflect a dollar to Naira black market exchange rate ranging between ₦1130 and ₦1175, averaging ₦1,160.00, according to ngnrates.com. In contrast, the standard bank rate stands at approximately ₦765, creating a significant gap of nearly ₦410 per dollar.

The CBN’s concern centers on the perception that individuals engaging in Naira-based transactions for foreign goods are primarily motivated by profiting from currency exchange. Consequently, they initially imposed limitations on Naira cards, restricting monthly foreign expenditures to a mere $20 and eventually prohibiting Naira cards altogether for international payments.

As Nigerians, especially those engaged in online work, we face a pressing need to buy products from platforms like Amazon or AliExpress, pay for online advertising as affiliate marketers, and cover expenses for software, domain names, and website hosting – all of which invariably require transactions in dollars. The question that arises is, what are the most effective means of navigating these challenges and ensuring seamless international payments?

Today, we will delve into the realm of debit cards, International Bank Accounts, and virtual debit cards.

Contents

6 International Bank Accounts and Debit Cards for Nigerians

We have physical and virtual debit cards. A virtual debit card don’t really need to have a physical account number, but it can require International Bank Accounts and card details online, which majorly of it can be in dollars, euros, or pounds sterling account. And then you can now use that to buy anything online.

Let me show you some of the platforms that offer International Bank Accounts, and physical and virtual debit Cards, so that you as well can utilize any of them to buy things online.

1. Grey.co

Grey International Bank Account, formerly known as Aboki Africa, can fill this gap if you’ve been seeking for a means to receive money from outside because it allows you to set up a virtual International Bank Account that can hold dollars, pound sterling, and euros.

Grey enables you to receive money from abroad and convert it to Naira with ease. You can transfer USD straight to your domiciliary account, send money to your bank account or use their virtual debit card to actually buy things online and it’s easy to do.

How to Register for a Grey Account

You can register a Grey account in a minute and receive money from abroad if you’re a Nigerian. You only need your docs (Government-issued IDs and your utility bill) to complete the verification process.

- To create a Virtual International Bank Account, download the Grey app by clicking this link.

- Open the app and select “Get Started,”

- Use my code as your referral code: GL1UDH

- On the registration screen, complete the necessary fields, double-check your entry, and then select Create your account.

- An email will be sent to you asking you to confirm it. After you’ve successfully validated your email, you’ll need to finish your KYC in order to verify your newly created account.

After that, you can create a Grey Virtual Account and apply for Virtual Debit Card.

How to Create a Grey Virtual Debit Card

Are you set to obtain a Grey virtual debit card? Just adhere to the instructions below;

- Login to your Grey account.

- Tap the “virtual cards” button.

- Tap “create card” under the section.

- Follow the rest on-screen instructions to obtain your card.

2. Chipper Cash USD Virtual Debit Card

Chipper Cash has been around for a while and is well-known to many readers of this blog. You cannot get the Chipper virtual USD Card unless you have a Chipper Naira account.

You can find more information on how to create a Chipper Cash account here, and if you have already created and verified your Chipper Cash account, you can move on to the steps for activating your Chipper virtual USD Debit Card.

How to Activate Chipper USD Virtual Debit Card

Launch the Chipper Cash and log in to your verified account

- Firstly, you need to add Naira to your Chipper wallet.

- Simply tap on the “Add Cash” icon on the home screen of the app

- Your Personal Chipper Account number will be displayed to you.

- Simply send the money from your local bank to your Chipper Wallet via that account number

- Once your wallet has been loaded, tap the “Card” icon on your Chipper app.

- Select “Claim Card”.

- Enter the requested information and tap “Looks Good!” once done.

- Tap “Continue”. and Your ‘looking good’ Chipper Card is ready to go

Note that Chipper allows you to create both NGN virtual debit cards and US debit Cards, so take note when selecting the card

3. Flip by Fluid Coin USDT Virtual Debit Card

The Fluid coins have an app known as Flip by fluid coins and it works by funding your virtual debit card with USDT, a stablecoin equivalent to the US Dollar.

You have the flexibility to make payments online with Flip’s dependable virtual card, whether you’re taking courses on Coursera or placing purchases on Amazon, AliExpress, or Asos.

How to create a Flip USDT virtual debit card

- Download the Flip app for your Android or iOS device.

- Install and launch the app on your phone.

- Once it is opened, if you’re using an iPhone, it will ask you to continue with your Apple account. But if you’re using an Android phone, it’s going to ask you to continue with your Google account. And the app is saved for you to do that.

- Tap on the “Account” icon to set up a profile and verify the account

- Complete your KYC to move your account to Tier 2. You must complete a BVN verification and submit valid identification (NIN, Voter’s Card, Driver’s license, or international passport) in order to finish this process.

- Once you have completed the verification, the next thing is for you to go ahead and create a Visa card that can be used in making online payments.

- Fund your Flip wallet through your Nigeria bank.

- Go to the Cards section in the app and click on the “Create Card” icon.

- Create a virtual card. You will be required to fund your wallet with a minimum of $10 and pay a one-time fee of N1,000.

And voila! You currently own an International Bank Account and Virtual Debit Cards backed by USDT that includes your name, card number, security code, and zip code.

You can create one card for all the payments you want to be making or create a different card for different websites, maybe one for Amazon payments, another card for AliExpress payments, and so on.

The best thing about the app is that you can verify your account in less than 5 minutes, so you can be able to start using it to make payments on any online platform that you want to make payments.

NB: I can tell you that all of these websites are not 100% guaranteed. I’m not saying they will steal your money. But I’m saying there are some websites that will not allow you to use these virtual debit cards. So the fact that you have Grey debit cards, Chipper virtual USD debit Cards, and Flip USDT virtual debit cards doesn’t mean you can buy things from every website available.

You would be able to make unlimited purchases of goods using the next trio of payment methods I’m about to explain to you. The best thing is that two of them are physical cards produced by Nigerian banks.

They are UBA Prepaid Dollar Card, GTBank Prepaid Dollar Card, and PayPal account. Now I’m going to show how to go about these very quickly, so you can also get yours, they are very easy to get.

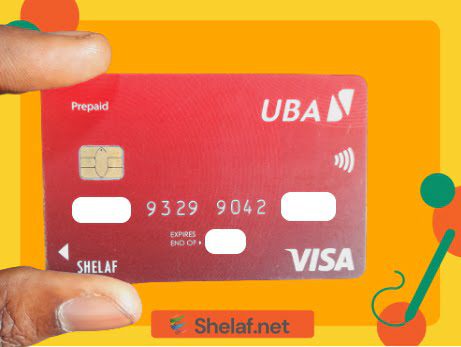

4. UBA Prepaid Dollar Card

All you have to do is go into any United Bank of Africa (UBA) branch in your locality. You don’t need to have an account with them, if you like you can open a savings or current account with them. But you don’t really need that for a prepaid card.

There are two different types of UBA prepaid cards. There is a Naira prepaid card and a dollar prepaid card.

Tell them in the bank that you want to get a dollar prepaid debit card, and they’re going to give you the forms to fill out. But before you go, please go along with your identification.

You only need your driver’s license or international passport or voter’s card or national ID card, one of those will work even if it’s temporary, it will work, then you also need proof of your residence which is your address, so mostly NEPA bill is okay, and then you can have that but then as soon as you do this or you fill it or before the account can be activated, you need to do a deposit of $10.

This $10 is not just $10 in transfer, it’s a physical dollar. That’s what you are going to deposit on the counter at the bank. And then you now have an International Bank Account, you will be given a physical debit card which is what you will now use to make international online transactions.

But then every time you have to make the transaction, there are a few things that you have to note, it will need you to deposit the dollar equivalent into your bank. So, if you want to buy something worth $100, you must either transfer money from your PayPal account to the card or go to your domiciliary account, withdraw the money, and then return to the UBA bank to deposit it. That’s how you can use it to make transactions online with no limits. If you like, you can use $10,000 per day.

That is what I’m using to buy domain names, pay for web hosting, and online ads, shop online, and my other online tools. You as well can use it. However, there is another one, which looks easier, just like this. It is the GTBank Prepaid Dollar Card.

5. GTBank Prepaid Dollar Card

A global payment card, the GTBank Prepaid Dollar Debit Card is issued in collaboration with MasterCard Worldwide or VISA International.

Customers of GTBank and non-customers can get the card right away to meet all of their different payment demands.

To open a GTBank Prepaid Dollar account. It’s also easy, below are the requirements:

- Non-Account Holders

- Completed Application form

- One recent passport photograph

- A recent utility bill

- A copy of your Driver’s License or International Passport

- Issuance fee of N1,000

- Annual Maintenance fee of $10 (or its equivalent in dollars)

If you have a dollar card, you can use it to make whatever online purchase you want without any restrictions. But I also utilize another method to make internet purchases. The method is PayPal.

6. PayPal account

You cannot register a PayPal account to send and receive money in Nigeria, but I do. In fact, I have three international PayPal accounts here in Nigeria that I opened using the various methods described on this site.

One of the best ways to make an online purchase is through PayPal. Because you need to have a balance on PayPal or a dollar balance before you can use it to make purchases, there are no restrictions and you can make money online into the account.

Recommended: How to Withdraw Money from PayPal to a Prepaid Card and Collect the Dollar Notes in Nigeria Bank

Regarding Bytebus Cloud Mining, I really apologize if I offended anyone. I was shocked and disappointed by their act of stealing investors’ money and leaving people stranded, this left me dumbfounded when I saw your comments in the thread.

I acknowledge that this choice may have impacted some of you personally, and I apologize sincerely for that. Please understand that I did not want to offend or cause any pain. I appreciate your understanding.

It’s only right that we realize investing involves some risk as mature people. However, we have the power to decide how we want to go rather than allowing that to hold us back. Do we want to keep moving forward or pause for a time on our path to success? Regardless, it’s crucial to act in a way that will benefit us and our future.

I wanted to take a minute to inform you all that I have made the decision to entirely shift my focus away from sharing those cloned Ponzi schemes and hazy multilevel marketing prospects. Although it may be alluring to try to use these tactics to make money quickly, I have come to the conclusion that they are frequently unreliable and not a sustainable approach to making money.

I’ll be offering tutorials instead on valuable skills you can utilize to earn reliable money online. You are encouraged to visit our website frequently to learn more about these genuine, tested ways to make money online. Whereas, the first step is to obtain those accounts and the dollar card.

I appreciate your support and hope that these additional tutorials will aid you in achieving financial success.

Thank you for reading. If you have questions arising from this, put them in the comment section and I’ll respond to them.

If you like what I’m doing on this blog and you are still not subscribed, then you aren’t doing me any favor. So please click here to follow Shelaf’s daily latest posts and don’t forget to share this post with your friends and families, it will help a lot.

14 thoughts on “6 International Bank Accounts and Debit Cards for Nigerians to Make Payments Online”

Yes! Innocent shelaf we understand your position.This is sometimes inevitable I feel it for those that have invested much in Bytebus. But it is better as you finally spoke. Integrity is important. We cannt stop here but caution.

Hi Cosmos,

Thank you for your comment. I apologize for the delay in my response.

I agree that integrity is important. I appreciate your support as we work through this challenging issue. We will continue to move forward with caution and transparency.

I want to make it clear that, according to my Bytebus dashboard referral statistics, not many people have invested much from this blog except if others boycott my referral link. Only one person and I invested a significant amount of capital, and I have reached out to the person, he verified to me that he was able to get his money back through daily profits and a little bit of profit before the website crashed. The same thing happened to me as well. I am aware of only two other people who invested $100 each, but I’m not yet aware of their current positions.

I do have many audience members who dealt with their free plan and may have wasted their efforts and time, for which I am sorry. I hope to make it up to them, with more genuine content in the future.

Once more, thank you for your understanding.

I invested my last $200 on bytebus through your link sir, and I lost them all including the profit

I’m sorry to hear that you lost your investment in Bytebus. Investing in cryptocurrency can be risky and it’s important to be aware of the potential for loss. I would recommend seeking financial advice and only investing what you can afford to lose. I hope that you’re able to recover from this setback and find success in your future investments🙏

It’s important to me that all feedback is sincere, so I want to mention that I am not seeing any trace of you investing $200 through my referral link on my dashboard. I want to make sure that you did indeed use my link and that there was no confusion or misinformation.

If I put money on grey and want to withdraw it will it be in black market price rate

Hello Raul! It’s essential to clarify that if you put money on Grey and want to withdraw it, you will indeed be subject to the black market price rate. As of now, the conversion rate stands at 1 USD, which equals 821.85 NGN on the Grey market.

Keep in mind that these rates can be subject to fluctuations. Exercise caution and be aware of the risks involved when dealing with platform market transactions. Always stay informed about the current rates to make informed decisions. I hope this helps!

Thanks alot It really help I want to forward money from my Payoneer account and have been looking for Any online banking platform that I can withdraw it with black market rate to my bank account

I’m glad the information was helpful to you. If you want to forward money from your Payoneer account and withdraw it at a black market rate to your bank account, Grey is an excellent option to consider.

It’s essential to avoid sending money through old Grey US bank account details to prevent any potential issues with funds hanging. Instead, make sure to use their new US account details for smoother transactions. And it’s great to know that the old GBP and Euro Grey accounts are still working fine.

Additionally, I want to share another reliable platform recommendation with you, but it does require a CAC certificate for business verification. If you have the necessary documents and are interested in exploring this alternative platform, feel free to contact me for further details. I’d be happy to assist you in any way I can.

As always, be cautious and informed while dealing with financial transactions, and I hope these suggestions make your money transfers a seamless experience. If you have any more questions or need further assistance, don’t hesitate to reach out. Best of luck with your transactions!

Thanks alot I think I will go for the grey then I will send money to it and withdraw it

You’re welcome, Raul-Gold! It sounds like you’ve made a decision to go with Grey for your money transactions. That’s a great choice! Grey can be a reliable online banking platform for handling such transactions, and I hope it meets your needs perfectly.

Sending money to Grey and then withdrawing it, is a feasible way to access funds and potentially benefit from the black market rate for your currency exchanges. Just remember to stay informed about the latest exchange rates and follow the platform’s guidelines to ensure a smooth experience.

If you have any more questions or need further assistance while using Grey or with any other financial matters, feel free to reach out. I’m here to help! Best of luck with your transactions, and I hope everything goes smoothly for you!

Wema Bank Debit Card is not on the list as the recently enable international payment

Hi Emmy,

Thanks for your comment. We appreciate your interest in Wema Bank’s debit card and international payments. Just to clarify, this post has been brought to the top for everyone to see, as it’s indeed a trending topic. If you’re looking for more information about the Wema Bank ALAT Mastercard and Visa for international spending, we have a dedicated post with all the details. Simply click here to read it and get the information you’re looking for. We hope you find it useful!

Hello Shelaf,

I have an unresolved issue. I created an account on Grey but I cannot set up a USD account however creating a British Pound and Euro account was easy. What can I do to resolve this?

Hey DB,

Good news! Your frustration with setting up a USD account on Grey is over. You’re right, there was a temporary pause on USD accounts, but I’m thrilled to tell you they’re back and easier than ever to get!

Forget your past struggles; creating a USD account now is just a few clicks away. Here’s what you can do:

1. Update your Grey app if you haven’t already.

– For Android users: Head to the Play Store and tap “Update” next to the Grey app.

– For iOS users: Open the App Store and tap “Update” next to the Grey app.

2. Head to your Grey dashboard and click “Get your IBAN.” This button should be readily available on your main screen.

3. Follow the prompts and fill out the form with your accurate information.

4. Once submitted, sit back and relax! Grey will review your request and get you set up with your USD account in no time.

That’s it! You’ll soon have access to all the benefits of a Grey USD account, including:

– Receive payments in USD directly.

– Make international transactions with ease.

– Hold your USD securely and conveniently.

Don’t hesitate to reply or reach out to Grey’s support team if you have any questions about the process. They’re always happy to help.